Business Challenges In Today’s Store

Our brand new store report has just released, and it provides stunning clarity into how retailers plan to help bring their largest investments back to life. As the stores try to find their way in a brand new digital world, we asked retailers to candidly share their experiences. The best performers have a vastly different take on what the future holds for stores: Figure 1 shows just how different that vision is.

Figure 1: The Big Picture

Source: RSR Research, May 2013

The contrast couldn’t be any clearer: Winners plan to open new stores – not only in the geographies where they’ve already had success, buy also in new markets around the globe. They view stores as a vital component to their overall brand offering. Yes, consumers may be using any number of physical and digital channels in their paths to purchase, but stores still play a vital role in that equation, and their plans reflect this fact. By way of comparison, laggards seem to have given up on the store entirely. Perhaps they already have too many stores. Perhaps they need the money; but no matter the reason, one in two struggling retailers is planning to close stores in the near future (compared to 10% of Winners), and another 21% say they just plan to stop opening stores altogether. Whatever plans they do have for expansion are for smaller-format stores than what they currently operate.

While it is important to recall that Winners are looking through an optimistic lens at the future of the store (and laggards a dire one, from Figure 1), Figure 3 sets the stage for the overall retail environment right now: Those who are “in the know ” recognize their stores need technological revitalization, and are addressing that need post-haste. Laggards, on the other hand, just don’t “get it “: they have labeled the store as irrelevant, when in fact it is their lack of attention to those stores that has made their locations undesirable to consumers in the first place. Quite simply, why would a consumer want to visit an antiquated, poorly arranged store whose personnel can’t answer even the simplest of product questions? It becomes a self-fulfilling and downward spiral.

From Here to There

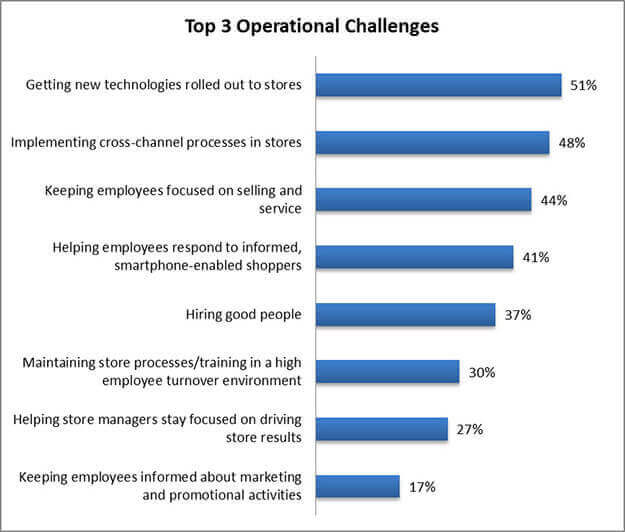

When it comes to operational challenges, getting exciting new store-based technologies up and running – and playing well with both new andexisting cross-channel tools – takes top honors. But the most interesting data points in Figure 2 are the 48% of retailers who acknowledge that implementing cross-channel process in stores is a top challenge, and that keeping employees focused on selling and service is, as well (Figure 2).

Figure 2: It Ain’t Easy

Source: RSR Research, May 2013

This makes perfect sense; for the best retailers, the store must evolve, and that means it’s going to be a significant challenge to ensure new store-based technologies do not operate in a vacuum. Consumers don’t care about “channels “, and new store systems will only be of value if they interoperate with all the other “channels ” retailers operate. For the worst performers, this challenge may prove difficult enough to phase them out completely. Laggards’ problems are only further compounded by how little importance they place on an educated, helpful staff in stores: only 13% (compared to Winners’ 38%) identify hiring good people as a top priority.

The full report examines much more of the challenges, opportunities, and technologies retailers perceive as being most helpful during this transformative time, and as always, we find stark differences throughout based on retailers’ sales performance. We hope you’ll take the time to read it here.