Big Data in Merchandising: Retailers’ Point of View

Paula’s article this week on big data caused me to take a look at what our respondents had to say about the topic in our most recent Merchandising Report. While the market works to create a more concise – and unified – definition of what big data not only is, but what retailer can actually do with such information, retailers tell us many of the inhibitors to practical use today remain within their own organizational structures.

As to be expected, the inhibitors vary by retailer size, product segment, and performance (more on that in a moment). But to Paula’s point, the good news is that retailers are aware of the cultural change required; for most, the challenge isn’t in the technological capabilities of new solutions available to them, but rather, in getting their own houses in order to make use of such data. Take a look.

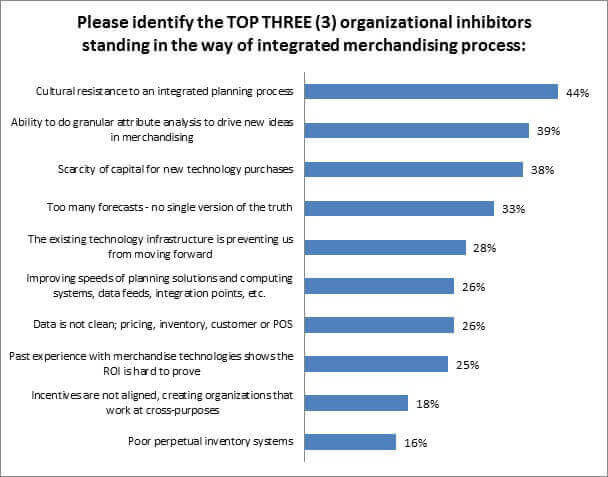

We asked retailers what stands in the way of moving forward with integrated merchandising processes. Cultural resistance to an integrated planning process was the most frequently cited inhibitor to forward progress (Figure 1).

Figure 1: Resistance is Futile

Source: RSR Research, August 2012

In some ways, the data in the chart above can be viewed as a positive: resistance to change is always inevitable, and implies that the organization is prepared to make that change.

And in both 2010 and 2011 studies, retailers concerns were more data driven; they reported significant problems trusting the cleanliness of their pricing, inventory, customer and POS data (39% in 2010, 49% in 2011). This year, only one in four retailers (26%) cites data cleanliness as a top inhibitor. That’s straightforward progress in an area retailers can control through their information systems and procedures: you may not be able to change human nature’s ingrained resistance to change, but cleaning up the information stream that dictates your every merchandising decision? That’s in retailers’ control, and they are making progress.

Here are some differing results by respondent group that we point out in the full report:

- Fewer Winners (14%) are concerned about incentive misalignment (creating organizations that work at cross-purposes to each other). Average performing retailers have the hardest time getting these incentives aligned, as 37% report it a top-three inhibitor.

- Not surprisingly, Winners have fewer problems freeing up capital for new technology purchases (25% vs. average performers’ 53% and laggards’ 43%)

- Data cleanliness does remain an issue for smaller retailers, likely a direct result of their holding onto legacy (or homegrown) systems and their reticence to move to more modern merchandising tools Similarly, they report “the existing technology infrastructure is keeping us from moving forward ” at a much higher rate than any other revenue band (43% of small retailers, only 8% of 1-5 Billion retailers cite existing infrastructure as a top inhibitor). Our take-away here is more directed towards technology vendors than it is towards the retailers themselves. It’s imperative to make cost-effective, easy to implement technology solutions available to small-to-mid-market retailer. We expect to see different delivery models like Software as a Service and other on-demand options made available in the coming years to support this demand.

- Mega retailers, while reporting slightly more difficulty proving merchandising systems’ ROI, are much less inhibited by their ability to drive new ideas via granular attribute analysis; virtually all other retailers report their inability to conduct granular attribute analysis as a serious roadblock to better merchandising processes (46% of $1-5 Billion retailers cite this a top inhibitor)

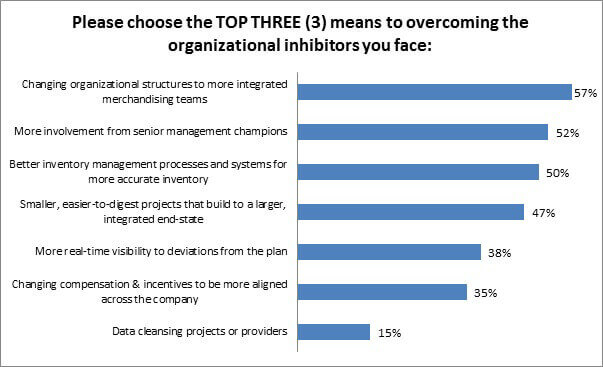

Retailers know that in order to get past these roadblocks, they need to change their organizational structures and create more integrated merchandising teams (Figure 2).

Figure 2: Getting Past the Problems

Source: RSR Research, August 2012

Interestingly, retailers selling fast moving consumer goods are most bullish on the notion of changing their compensation and incentives to be more aligned across the company (45%, compared to GMA’s 30%), one of the few areas where they do not lag behind other segments in both current technology usage and forward-looking processes. Some other variances by demographic:

- FMCG retailers are more eager for better inventory management process and systems to improve inventory accuracy (65% vs. 46% of GMA retailers)

- Mid-market retailers appear far less aware of the value of senior management champions (only 33% of those with sales of $51-$999 million see the need for such advocates). By way of comparison, 70% of the largest retailers see this role as a vital component to getting past internal roadblocks. This is a vital and missed opportunity for the mid-market.

Operationally, the best performers have a generally better understanding of what they need to change to improve their merchandising strategies, and we take a deeper dive into these differences in the full report, which is available for everyone to read by visiting our site.

But as my partner so clearly states in her piece this week, words only get you so far: the “big data ” buzzword has served its purpose in getting to the top of retailers’ to-do lists. The best retailers are now poised for action.