A Merchandising Conundrum

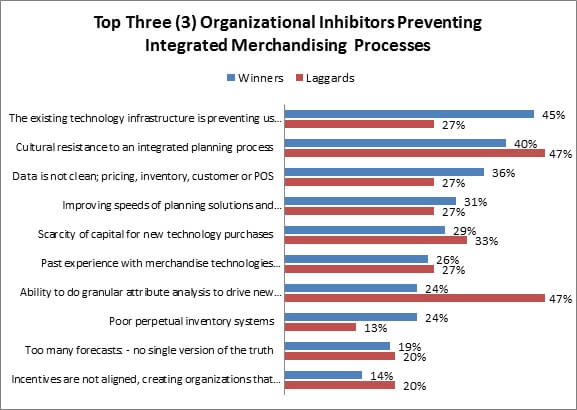

In our recent merchandising benchmark, retailers tell us they need significant help improving their merchandising practices. On the surface, what’s impeding forward progress is their existing technology infrastructure, internal cultural pushback, and impure data (or the inability to trust that data’s potential to be clean); the same challenges that plague them year after year. Or to simplify it even further: the current state of merchandising is preventing the future of merchandising from happening as it should. However, when viewed by performance, we see that Winners and laggards are facing starkly different realities, and as a result: different obstructions within those realities (Figure 1).

Figure 1: A Matter of Vantage Point

Source: RSR Research, September 2013

Winners’ top roadblocks are all indicative of their disproportionate effort to date. They have a far better knowledge of the fact that their infrastructure is an impediment, their data is not clean, and that they have poor perpetual inventory systems – not because they are ascribing random blame, but because they are further into the process of addressing their internal issues.

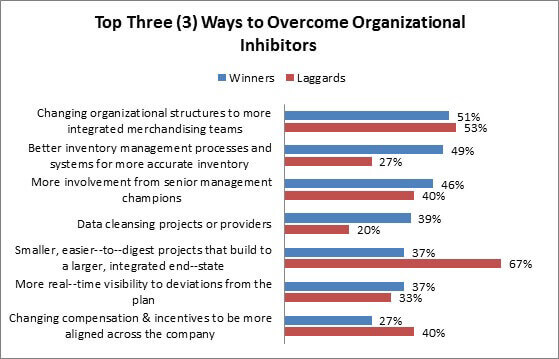

Laggards, on the other hand, look to place the blame elsewhere (more on that in a moment) – in this case, blaming their attribute analysis tools’ lack of ability to get granular enough (47% to Winners’ 24%) for their troubles. It is a trend that continues in the following chart (Figure 2), where not only is Winners’ pain a result of their enhanced effort, but their way out reflects the inroads they’ve already made, as well.

Figure 2: Chicken or Egg?

Source: RSR Research, September 2013

Laggards immediately tell us that that, for them, the keys to the kingdom have to come from someone else – and that they’ll have to be small. Sixty-seven percent of underperforming retailers (vs. 37% of Winners) say that only once merchandising projects become more easily digested will they have a feasible chance of building to a larger and integrated end-state. This strikes a chord for a couple of reasons: firstly, the poorest performing retailers consistently look to ascribe blame elsewhere.

Regardless of the topic we are studying, laggards perennially look for an “outside ” reason they haven’t been able to progress. By way of comparison, Winners have the harder conversation: looking internally at what they can do differently to move forward.

We invite you to read the full report, Merchandising Today, by following this link.