A Bright Spot On The eCommerce Horizon

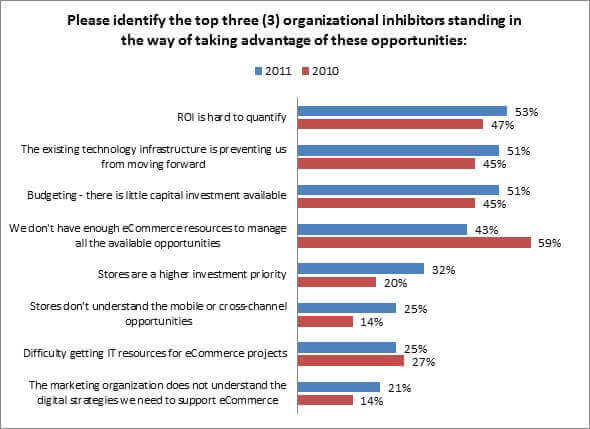

In our most recent eCommerce study, we (of course) ask about what retailers perceive as the roadblocks which stand in their way to moving forward on the countless opportunities better eCommerce practices and technologies afford them. While not a lot has changed in the past 12 months, one very positive trend emerges: retailers are starting to get a handle on prioritizing and managing the resources necessary to capitalize upon the multitude of online opportunities available to them.

Figure: A Bright Spot Emerges

Source: RSR Research, January 2012

This data point ( “We don’t have enough eCommerce resources to manage all the available opportunities ” – 59% last year, down to 43% this year) has emerged as a significant pain point for retailers since we first started conducting this research four years ago, and the 2012 report data marks the first time that significant inroads have been made. “We love the concept of all of the rich eCommerce bolt-on functionalities we see at tradeshows, but simply don’t have the manpower to make use of them all ” has morphed into something new: retailers are narrowing down the field of new technologies to ones they think the customer will appreciate most, and they increasingly recognize the need to prioritize and start managing them sooner than later. This is the direct result of eCommerce’s growing popularity among shoppers (and its consequently renewed interest among high-ranking LOB leaders), as well as increased pressure from such players as Amazon, forcing smaller and specialty retailers to take the leap in order to stay competitive.

Tension and Experimentation

While a streamlined technology platform/infrastructure earns top honors as the best way to overcome internal roadblocks (58%), another emerging story is the tension and communication challenges that exist between eCommerce and the marketing department. This was a brand new option for survey takers this year, and with 52% of the total response base noting it as very valuable, it is no small thing. Winners find it to be even more of a way through the obstacles of the existing landscape: 60% of Winners (and 65% of Double-digit Winners) cite more coordination with marketing as very important: for laggards, that number is only 43%.

What’s also interesting is the significant drop in respondents who cite “easier pilots ” as an integral component to getting past their internal inhibitors. Last year, 43% of retailers identified simpler pilots as a very valuable means to overcoming roadblocks, compared to only 27% this year. From this, we can deduce that the technology asset and its ease of implementation is evolving at a more rapid pace than that of retailers demands – and further still, retailers’ concerns about the feasibility of new eCommerce “add-ons ” are dwindling even faster. The net of the data confirms that:

- Retailers are becoming less beleaguered to allocate human resources to experiment with new eCommerce offerings; and,

- They no longer believe that piloting these new offerings will be as painful as it has been, even in very recent years.

Not surprisingly, Winners are even more bullish: 40% of Winners (and 47% of Double-digit Winners) cite “more experimentation ” as very valuable to overcoming their internal roadblocks, compared to only 29% of laggards.

Look Who’s Not Coming to Dinner?

What’s also surprising is that given the previous data surrounding eCommerce and Marketing’s need to get on the same page with online offerings faster and in a more cohesive fashion, few retailers think Marketing needs to increase its participation in the strategic direction and management of eCommerce going forward. Instead, our respondents tell us that Supply Chain Executives’ input is drastically underrepresented (26% currently participate, while 41% want increased supply-chain influence). Clearly, as consumers’ demand for whatever they want, however they want it grows, the ability to fulfill those orders across a globally distributed supply chain becomes more of an issue. If you operate stores, and online stock is depleted, how do you manage fulfilling online orders where product is plucked from store inventory? If stores are out of stock, how can the eCommerce channel be best leveraged to save the sale? These challenges are growing daily, and the need for Supply Chain Executives’ seat at the eCommerce table to navigate their implications grows with them. Winners’ are driving the importance: 43% of Double-digit Winners want increased participation from their supply chain personnel.

We invite you to read the full report, available to all on our website here.