The Modern Supply Chain: A Multitude Of Challenges Collide To Create One Perfect Enemy

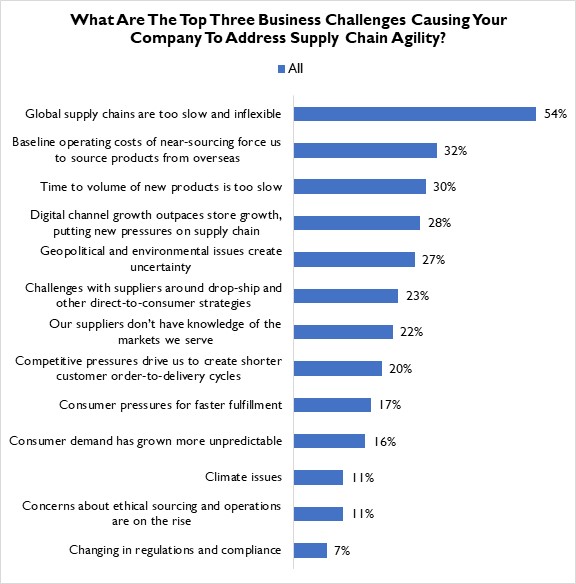

Brian’s piece this week helps highlight how retailers’ needs for both agility and resilience are at loggerheads – particularly as it relates to the supply chain. With so much pressing in on retailers’ four walls, we offered the respondents in our latest survey into supply chain issues a long list of external challenges preventing them from being more agile and asked them to the top three driving them towards the need to change.

As the figure below shows, we didn’t need to offer such a lengthy menu of choices. More than half of retailers immediately point to how slow and inflexible existing supply chains have become. This was a problem prior to the COVID-19 outbreak: it has since become both a crisis and a strong motivator to act.

Figure 1: The Sum Of Many Parts

Source: RSR Research, April 2023

Everything, Everywhere, All At Once

This is not to say retailers aren’t plagued by other external issues: the growing unpredictability of customer demand is part and parcel to why retailers can no longer abide such slowness and inflexibility: as are many of the lesser-selected choices within Figure 1, above. For example, suppliers’ lack of understanding of the market retailers are required to serve, climate issues, and uncertainty stemming from geopolitical issues ALL have effect (22%, 11%, and 27% of retailers identify each option, respectively, as a top-three issue). But what these ensuing data points truly expose is a supply chain network that is too staid and brittle to adapt to any one of them, let alone all of them all at once.

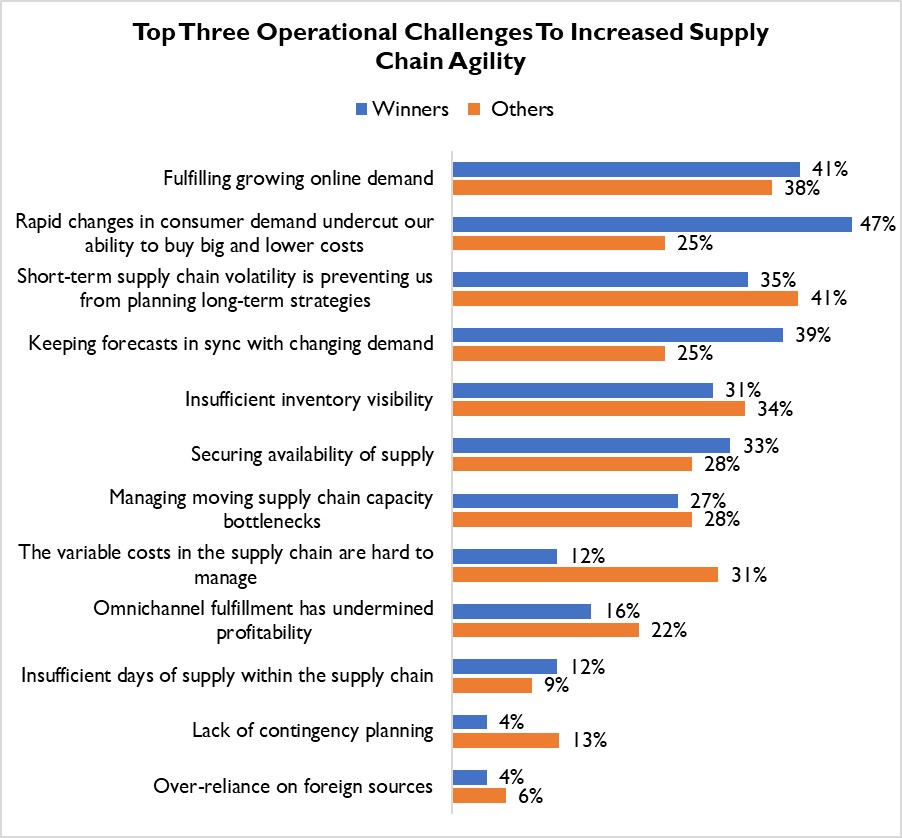

Such is the picture of what is happening well outside the bounds of what a retailer – for all but the largest and most powerful brands in the business – has the ability to control. But what about the things they can control? The Operational Challenges that exist within their day-to-day operations? As Figure 2 reveals, the answer depends heavily on a retailer’s performance.

Figure 2: The Times, They Are A-Changin

Source: RSR Research, April 2023

The best performing retailers, those whose sales are already outperforming the norm, say they no longer have the ability to buy in the larger quantities that enable them to enjoy lower costs. While this may seem like an internal choice to create a more diverse product mix, Winners argue that it is the direct result of a changing set of customer demands. They simply don’t have the confidence to buy products in as large of quantities as they did even just a few short years ago, and therefore, are hedging their bets. It’s a strong indicator of why they also ascribe such an elevated value to forecasting tools that will help keep them in syn with demand – as it changes. These tools present the opportunity to create more confidence in “what’s coming next”, and therefore plan – and buy – with a higher degree of certainty.

We invite everyone to read the full report here.