Training The Store Workforce: More Tasks, More Training

There has been a lot written recently about the workforce in general and the retail store workforce in particular.

The U.S. Bureau of Labor Statistics recently reported that for March 2022, the overall unemployment rate was 3.4%[1], near historic lows. For “Wholesale and Retail”, the unemployment rate is slightly higher, 4.6%.

At the same time, RSR and many others have commented on the more complicated nature of work in the store, due to all the additional tasks associated with omnichannel customer order fulfillment, returns handling, and other customer-facing activities. Just to give you some sense of how work in the store has changed, consider this: in October 2021, Supermarket News reported that “Of nearly 42,000 grocery customers in 20 states polled … 43% shopped online in 2020, up 80% from 24% in 2018.”

We’re currently conducting a new study on the state of the store workforce (scheduled for a May release), and responses tell us just how much has changed since the pre-COVID days. For example, 65% of our survey respondents tell us that “Having stores meet more fulfillment-center-style tasks” is a high value activity, and 51% make the claim that they can perform those tasks satisfactorily. But remember: in 2019, fulfilling online orders in the store was a nice-to-have for most retailers! Buy-online-pickup-instore (BOPIS, or “Click & Collect”) changed all of that.

This leads directly to a discussion about how much training should retailers afford their store employees. In RSR’s 2017 benchmark study on the state of the retail store[2], we compared how many hours/year retailers should be training store employees vs. how much time they actually spent. In the report, we lamented that:

Quite simply, <the results are> simply awful and it’s an opportunity squandered… pity the existing store associate. More than half of surveyed retailers expect to spend less than ten hours PER YEAR engaging existing store associates in any kind of training, and 60% are sticking to it with less than ten hours per year! And these are the people on the front lines, expected to engage with customers, give shoppers a reason to stay in the store, and are the targets of technology empowerment… it’s also no wonder turnover remains high….”

In this year’s study, we get a chance to see how much has changed for retailers who are simultaneously trying to meet the service demands of modern shoppers, create interesting work for employees in a low-unemployment market, and keep control over labor costs. Training should play a big part in those efforts.

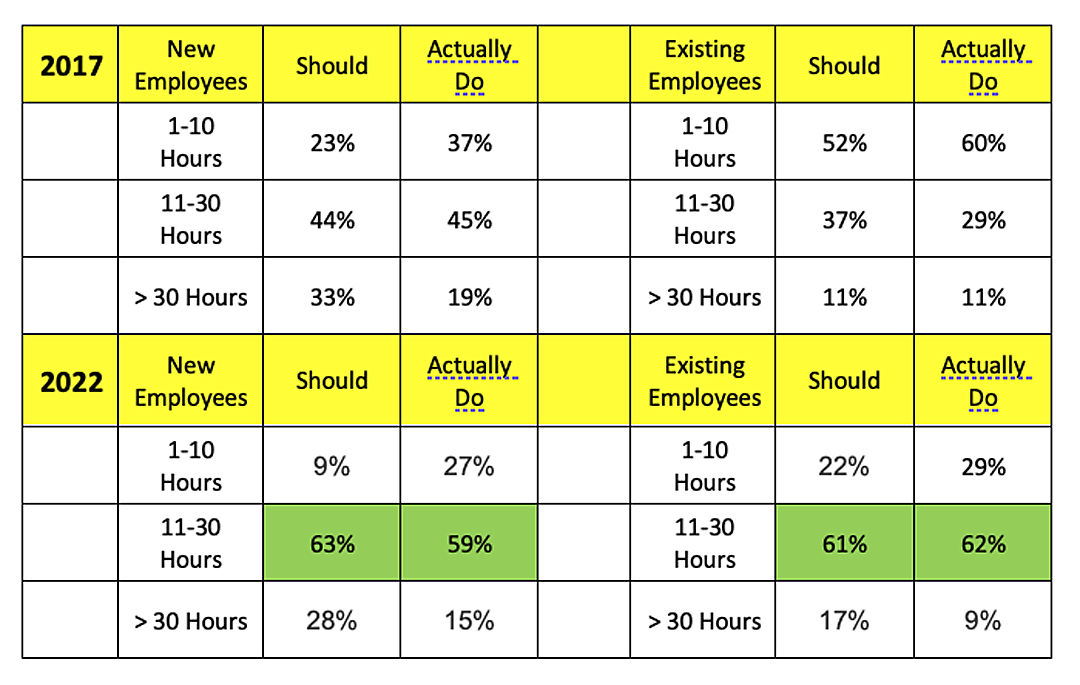

So, let’s compare! In 2017 and again in 2022, retailers responded to our questions about how many hours per year they thought they should spend on new and existing employees, vs. how much they actually spent. Here’s what they had to say:

As you can see in these comparative results, the new priorities in the store have indeed caused a shift in both the number of hours that retailers think should be devoted to training new and existing employees, and in how many hours they actually do devote to training. For both groups, the trend is clearly away from 1-10 hours/year to 11-30 hours.

This is a clear reflection of what is happening in the stores from the point of view of both consumers and employees. It’s also a reflection of retailers’ realization that the store remains a vital part of the overall value equation to consumers. There is no hint in the results that we’ve collected so far of the “Retail Apocalypse”. While many in the investment community still consider it to be more or less a zero sum proposition, i.e., that increases in sales attributed to Ecommerce equal decreases in store sales, the situation on the ground paints a far different picture: retailers are investing in their store staffs.

Stay tuned for more insights like this in RSR’s next benchmark report on the state of the store workforce, due out on May 19th!

[1] https://www.bls.gov/news.release/pdf/empsit.pdf

[2] https://www.rsrresearch.com/research/the-retail-store-in-2017-the-change-imperative